Assessing and Mitigating Common Red Flags in Tokenomics

We explore the critical red flags to watch out for in tokenomics, empowering you to make informed and confident decisions.

We explore the critical red flags to watch out for in tokenomics, empowering you to make informed and confident decisions.

Market makers are vital for ensuring liquidity in the fast-evolving world of blockchain, tokenomics, and decentralized finance (DeFi). They operate on both centralized (CEXs) and decentralized exchanges (DEXs), bridging the gap between supply and demand. However, market making strategies vary depending on a project’s tokenomics. This article explores the distinct strategies used on CEXs and DEXs, highlighting how they align with a project’s long-term tokenomics and sustainability goals.

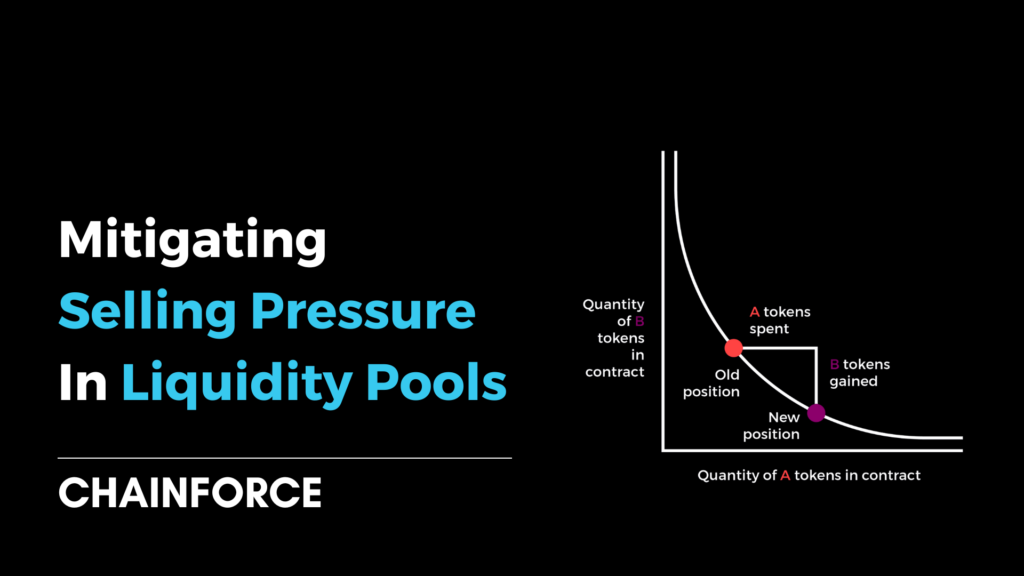

In crypto space, liquidity pools have emerged as a cornerstone for ensuring market stability and facilitating seamless transactions.

Understanding the definition and basics of tokenomics is essential for anyone involved in the crypto space or managing a Web3 project.

There are two primary approaches to liquidity creation. These are decentralized exchanges (DEXs) and centralized exchanges (CEXs).

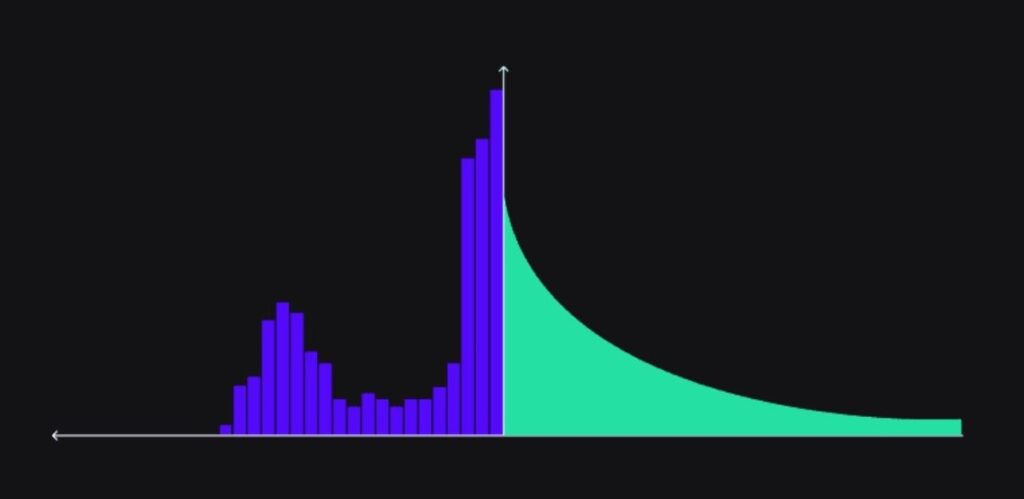

The article explores token vesting schedules and their significance in tokenomics, detailing various types and providing guidance for designing tokenomics tailored to specific project needs. It addresses common challenges and aims to equip stakeholders with the knowledge and tools for strategic alignment with project objectives and timelines.

In the ever-evolving field of tokenomics, innovative mechanisms are continually being developed to enhance value, ensure stability, and align the interests of stakeholders. One such strategy that has gained prominence is the “buy-back and burn” mechanism. This approach involves a project purchasing its own tokens from the market and then permanently removing them from circulation. However, over time, this mechanism has been refined to counter its disadvantages and add even more value through innovative buy-back mechanisms.

Diving into the changing role of tokens in the crypto world, this article explores whether your Web3 project truly needs one and highlights cases where tokens are crucial, beneficial, or potentially problematic.

Explore the intricate principles of tokenomics in the crypto world. Discover why token design, incentive structures, and more are pivotal to your crypto project’s success. Learn why tokenomics encompasses far more than just distribution and scheduling. Read our blog to uncover the secrets of a robust token economy and set your crypto journey on the path to success.