Token Economy Validation Through Simulations

Discover the power of Token Simulation, your key to a secure and thriving token economy. Through advanced simulations, we assess your ecosystem, identifying opportunities and mitigating risks to instill confidence in investors and your community. Our process explores growth scenarios, behaviors, and incentive impacts, offering strategic insights for your blockchain venture. Let us guide you towards a sustainable future with a robust token model designed for success.

The purpose of Token Simulations

Creating token simulations equips founders and investors with the power to foresee and navigate the complexities of the token economy in the fast-paced world of blockchain and cryptocurrency. By simulating various scenarios, we gain valuable insights into how token value might change with supply and demand dynamics, user interactions, and shifts in the market or regulatory landscapes. This foresight is crucial for designing resilient and robust token systems, ensuring the stability and sustainability of your token economy. Our expertise and deep understanding of the token ecosystem allow us to guide you through this process, making future challenges manageable and turning foresight into a strategic advantage.

Investor Confidence

A robust Token Simulation not only builds resilience into your token system but also enhances investor confidence. When investors see that you've meticulously tested and optimized your token ecosystem, they're more likely to trust in the longevity and success of your venture.

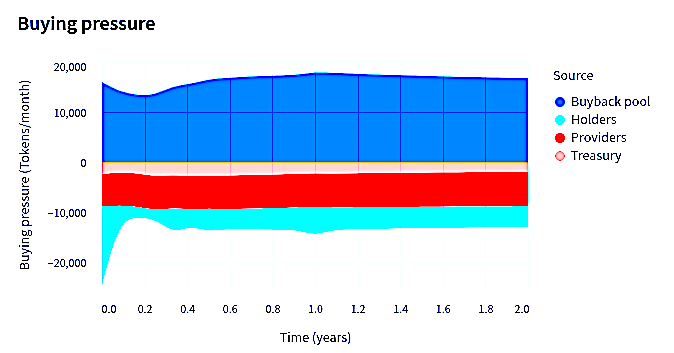

Selling & Buying Pressure

A key factor affecting a token's value is the dynamic between selling and buying pressures. Token Simulation allows us to model these dynamics under various scenarios, providing critical insights into how to balance token supply and demand.

Token Robustness

A token system is only as strong as its ability to withstand adverse conditions. By testing the robustness of your token against market volatility, regulatory changes, and other uncertainties, we can identify vulnerabilities and reinforce your token system to withstand these challenges.

Anticipate Growth Scenarios

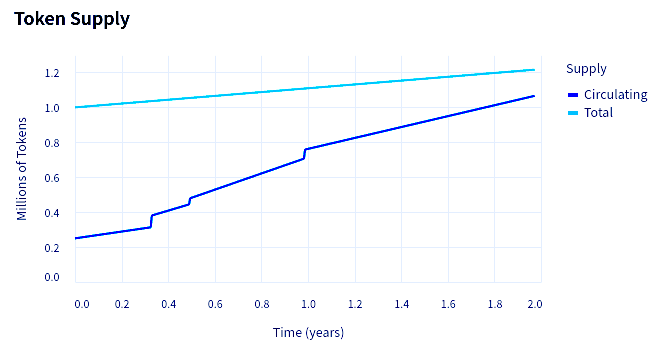

We simulate multiple growth scenarios, vesting schedules, and incentive models. This gives you a clear picture of how different variables and strategies could impact your token's growth trajectory, helping you to devise the most effective approach for your venture.

Identify Impact Factors

Every token ecosystem is unique and influenced by a range of factors. Token Simulation provides a deep understanding of the key variables impacting your tokenomics, enabling you to fine-tune your strategies for maximum effectiveness.

Mitigate Risk Scenarios

No one wants to consider failure, but anticipating potential pitfalls is a crucial aspect of risk management. By simulating various failure scenarios, we can help you identify potential weak spots and devise strategies to prevent these scenarios from becoming a reality.

We help founders & investors harness the power of token simulation to navigate the complex world of blockchain with confidence. We strive to ensure that your investments and ventures are not only secure but are also strategically positioned to maximize growth and profitability in the token economy.

How Our Simulations Work

At Chainforce, we understand the intricacies of simulating the token economy for complex ecosystems for which we employ a range of sophisticated models and software including agent-based models, econometric models, and game theoretical models. Through these simulations, we help businesses foresee potential challenges and devise effective strategies to bolster the resilience of their token ventures. At Chainforce, we approach Token Simulation as a systematic, multi-layered process that harnesses a variety of modeling techniques to forecast the behavior of your token ecosystem under different scenarios. Here’s an overview of how Token Simulation works in practice:

Agent-Based Models

These models simulate the behaviors of individual actors within your token ecosystem, capturing how their decisions and interactions could impact the overall system.

Econometric Models

Using economic principles, these models predict the behavior of your token under various economic conditions. They can provide insights into how changes in supply, demand, and price elasticity might affect your token.

Game Theoretical Models

These models explore the strategic interactions between actors in your token ecosystem. They can help forecast how different incentive structures might impact user behaviors and the overall health of your token economy.

Scenario Simulations

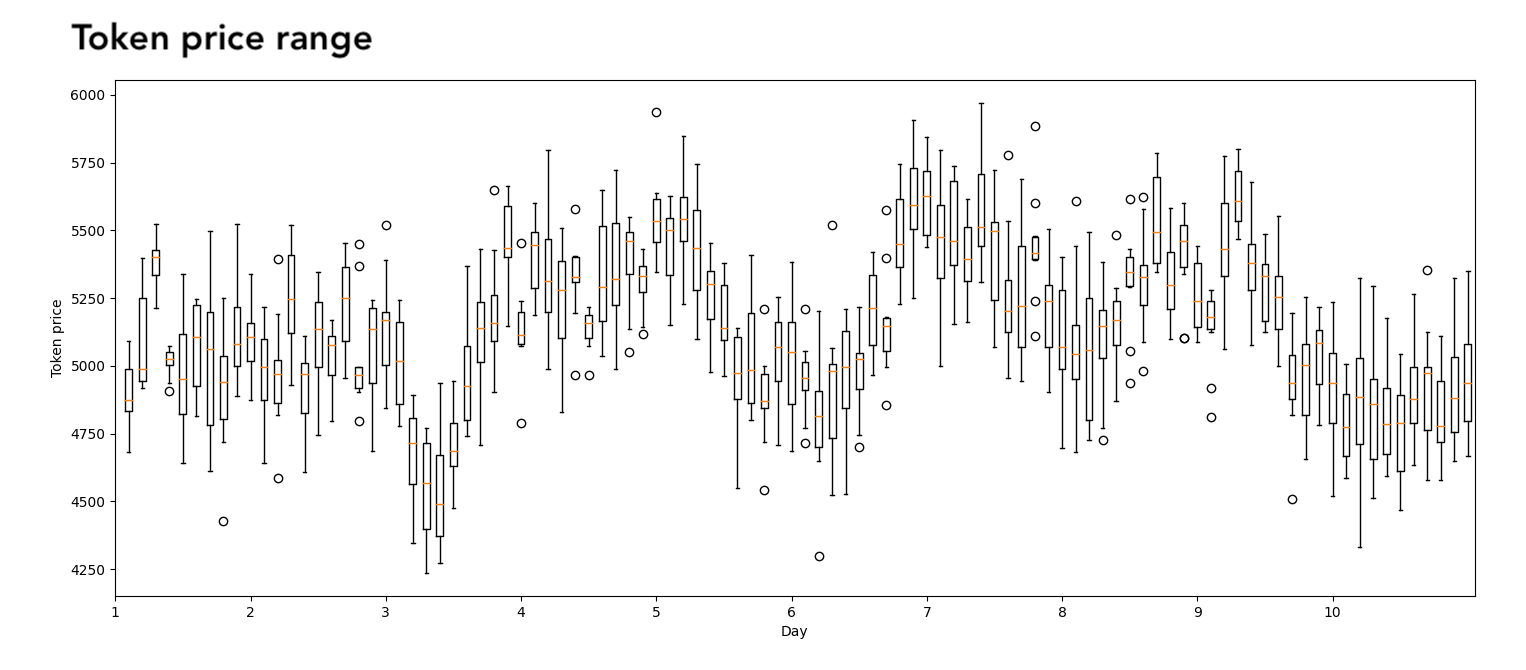

With the models in place, we initiate the simulation of multiple scenarios, ranging from various growth trajectories to buying and selling pressure dynamics, and even potential failure scenarios.

At this stage, we integrate your core business metrics – these typically correspond with your growth hypothesis and could include metrics such as “Total amount (in USD) of Loans”, “Daily Active Users”, “Total Value Locked (TVL)”, and others. We delve into how these key metrics influence the market pressure exerted on your token, creating a comprehensive understanding of your token dynamics.

This process empowers us to effectively gauge the robustness of your token, identify critical factors that shape your tokenomics, and gain insights into how different vesting schedules and incentive structures could potentially impact your token’s performance.

To add depth to our analysis, we consider examples such as, “How many tokens can an active user utilize monthly?” or “How many tokens are bought or burnt from loan fees?” These practical considerations add a layer of realism to our simulations, providing a clear perspective on how theoretical tokenomics translate to real-world scenarios.

Remember, at Chainforce, we don’t just provide you with data; we translate that data into meaningful insights that can directly inform your token strategy.

Visualization & Analysis

Finally, we visualize the outcomes of these simulations in a clear and accessible format. This enables us to analyze the results in detail, draw meaningful insights, and devise tailored strategies for enhancing the resilience and sustainability of your token system.

Token Simulation isn’t a one-off process, it’s an ongoing practice of testing, learning, and refining. At Chainforce, we work alongside you at every step, ensuring your token ecosystem is equipped to adapt and thrive in the dynamic world of today.

Building Your Sustainable Token Economy

At Chainforce, we do more than just simulate scenarios. We provide you with a detailed roadmap, clear insights, and strategic recommendations to ensure that your token venture is resilient and supporting the objectives of your venture. From defining your system parameters to building intricate models, simulating diverse scenarios, and visualizing actionable insights, we’ve got you covered.