Economics of AI Agents: Redefining Value in the Digital Economy

AI agents are rapidly emerging as powerful actors in digital economies (tokenomics), transforming how value is created, exchanged, and captured.

AI agents are rapidly emerging as powerful actors in digital economies (tokenomics), transforming how value is created, exchanged, and captured.

This early access to liquidity creates a misalignment between short-term financial gains and long-term project success.

This guide outlines the operational steps necessary for a successful token launch, emphasizing security, compliance, and alignment among stakeholders.

In collaboration with industry leaders, this event explores the creation of sustainable, value-driven ecosystems, highlighting key strategies for successful token launches and long-term growth.

We explore the critical red flags to watch out for in tokenomics, empowering you to make informed and confident decisions.

Market makers are vital for ensuring liquidity in the fast-evolving world of blockchain, tokenomics, and decentralized finance (DeFi). They operate on both centralized (CEXs) and decentralized exchanges (DEXs), bridging the gap between supply and demand. However, market making strategies vary depending on a project’s tokenomics. This article explores the distinct strategies used on CEXs and DEXs, highlighting how they align with a project’s long-term tokenomics and sustainability goals.

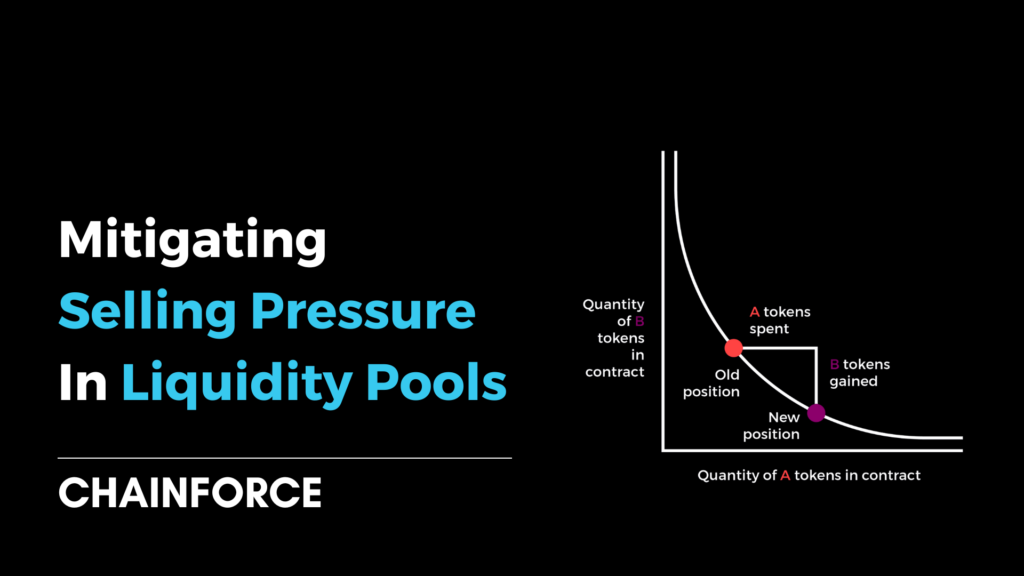

In crypto space, liquidity pools have emerged as a cornerstone for ensuring market stability and facilitating seamless transactions.

Together with our partners, we’re hosting a 2-hour deep dive into the essential steps that founders must take during tokenization.

Understanding the definition and basics of tokenomics is essential for anyone involved in the crypto space or managing a Web3 project.