In the rapidly evolving landscape of cryptocurrency investments, understanding investor tokenomics has become more crucial than ever. Digital assets are reshaping traditional finance, making a deep understanding of token economics vital for venture capital decisions. This shift has sparked interest in how tokens influence strategies, risks, and rewards for investors. The volatile crypto market offers valuable lessons from investor tokenomics for both experienced and new venture capitalists.

This article delves into several key aspects of crypto venture capital. It begins with the evolution of crypto venture capital, setting the stage for understanding how traditional investing principles have adapted to the crypto space. It then explores the various investment strategies used by crypto VCs. The text highlights how tokenomics plays a central role in shaping these approaches. The text discusses the challenges faced by crypto VCs. This discussion sheds light on the complexities within the crypto investment landscape. Notable success stories provide concrete examples of the potential rewards. They demonstrate the real-world implications of adept tokenomics analysis. Through this exploration, the article aims to impart critical insights into investor tokenomics. It offers a roadmap for navigating the intricacies of token investments in the crypto venture capital arena.

The Evolution of Crypto Venture Capital (Investor Tokenomics)

Early Days of Crypto VC

The journey of crypto venture capital began around 2010. This was marked by the establishment of the first cryptocurrency exchange, bitcoinmarket.com. Initially, the sector was largely driven by individual investors and smaller capital groups. These groups had a keen sense of opportunity. Notably, in 2013, a16z, a renowned Silicon Valley investment firm, made its first foray into the crypto space. It invested in OpenCoin, a startup focusing on cryptocurrency payments. This marked a significant shift. Traditional venture capital began to recognize the potential of cryptocurrencies.

Significant Milestones and Investments

Over the years, the crypto venture capital landscape has witnessed significant milestones. The introduction of Ethereum and the subsequent ICO craze in 2016-2017 catalyzed a new era of fundraising. This era allowed startups to bypass traditional venture capital. This period saw a dramatic increase in the number and scale of investments. By 2020, with the maturation of technologies like DeFi and NFTs, and an influx of institutional money, crypto venture funds became increasingly prominent, managing billions of dollars and driving the evolution of the investment landscape.

Recent Trends and Future Predictions for Investor Tokenomics

In recent years, the focus has shifted towards early-stage investments, with significant capital flowing into innovative projects that promise to expand the blockchain ecosystem. The first quarter of 2024 alone witnessed venture capitalists investing $2.49 billion into crypto and blockchain companies. This trend towards early-stage investment is seen as a positive indicator for the long-term health of the crypto ecosystem, suggesting a bullish outlook for the future of crypto venture capital.

Investment Strategies Used by Crypto VCs (Investor Tokenomics)

In the dynamic realm of cryptocurrency venture capital, investment strategies vary significantly, reflecting the complex nature of the market. Crypto VCs often focus on early-stage investments, targeting pre-seed, seed, or Series A and B rounds, driven by the potential for high growth in emerging crypto markets. Diversification plays a crucial role, with portfolios spread across various aspects of the crypto ecosystem, from exchanges and wallet services to blockchain infrastructures and decentralized applications (dApps). This strategy not only mitigates the risk of significant losses from any single asset but also potentially increases returns over time.

Diversification of Investments

In the realm of venture capital, especially within the volatile cryptocurrency market, diversification is not merely a strategy but a necessity. It plays a pivotal role in mitigating the risk of significant losses from any single asset while also potentially boosting returns over time. Consequently, VC portfolios are meticulously spread across various aspects of the crypto ecosystem, encompassing volume-related, user-related, and transaction-related investments.

Volume-Related Investments

These investments are characterized by fees that are calculated as a percentage of the trading volume. This category includes:

- DEXs/Trading: Decentralized exchanges that facilitate trading without central authority, capturing value from high trade volumes.

- Lending: Platforms where users can lend or borrow cryptocurrencies, generating revenue from the interest and fees proportional to the loan amounts.

- Launchpads: Services that help new crypto projects launch their tokens or coins, often involving significant volumes of token trades post-launch.

- Marketplaces: Online platforms where digital and sometimes physical goods are traded, with fees tied to the total sales volume.

- Lottery: Cryptocurrency-based lotteries where the volume of tickets sold translates directly into revenue.

User-Related Investments

Investments in this category generate revenue through monthly fees or adopt a Software as a Service (SaaS) model. This segment includes:

- dApps with Subscription: Decentralized applications that offer premium features for a subscription fee, catering to niche markets or specialized functions.

- Games: Crypto games that may require a subscription for access or monetize through in-game purchases and activities.

Transaction-Related Investments

These are investments where revenue is generated from fees charged per transaction, regardless of the transaction’s size. This category comprises:

- Layer 1 (L1) / Layer 2 (L2) Solutions: Fundamental blockchain technologies that improve transaction throughput and efficiency on the blockchain.

- Infrastructure: Investments in the foundational technology and hardware that support the running and security of blockchain networks.

- On-Chain Protocols (DeFi): Decentralized finance protocols that facilitate various financial services on the blockchain, like trading, lending, and insuring, all through smart contracts.

Integrated Value Propositions

Certain protocols integrate multiple value propositions to enhance their appeal and utility:

- GameFi: Combines gaming with financial mechanisms, often including a marketplace for trading in-game assets, games themselves, and loot boxes.

- Exchanges: Typically feature a combination of trading capabilities, lottery systems, and tools for user profile creation to enhance user engagement and revenue streams.

- Launchpads: Besides supporting initial coin or token offerings, these platforms might also integrate trading functionalities to maintain liquidity post-launch.

Short-term vs Long-term Investments

Crypto investment strategies can be broadly categorized into short-term and long-term approaches. Short-term strategies, such as day trading and swing trading, capitalize on market volatility to generate quick profits through rapid buy and sell decisions. In contrast, long-term strategies involve holding investments for months or years, focusing on assets with strong fundamentals and real-world utility, aiming for substantial returns despite market fluctuations.

Diverse Portfolio Strategies

To manage the inherent risks of cryptocurrency investments, VCs employ diverse portfolio strategies. These include spreading investments across different categories of cryptocurrencies, employing methods like dollar-cost averaging, and engaging in staking to earn rewards. Such strategies help balance the portfolio, reducing the impact of volatility and enhancing the potential for long-term growth.

Impact of Market Volatility

Market volatility significantly influences crypto VC investment decisions. The fluctuating market conditions necessitate strategies that can adapt to rapid changes. Techniques such as setting stop losses and only investing funds that one can afford to lose are crucial in managing the risks associated with high volatility. These measures ensure that VCs can navigate the turbulent market effectively, safeguarding investments against unforeseen downturns.

Learn more : ANALYSING WEB3 INVESTMENTS BY UNDERSTANDING TOKENOMICS

Evaluating Token Investments: Lessons from Conversations with Crypto VCs

Network and Deal Flow

Importance of Network: A robust network is indispensable in the crypto space. Connections with major industry players such as Binance, Polygon Ventures, Chainlink Labs, and the Solana Foundation are crucial. These relationships provide VCs access to premier deals and strategic collaborations that can significantly influence the success of an investment.

Co-Investments: Partnering with reputable co-investors like Animoca Brands, GSR, and Mechanism Capital can enhance both the credibility and potential success of investments. Such collaborations not only pool financial resources but also amalgamate diverse industry insights and expertise.

Venture Capital Beyond Capital

Strategic Value: Beyond mere capital provision, VCs add substantial strategic value to their investments. This includes mentorship, guidance, and leveraging industry connections to support projects, facilitating pathways to success in a competitive market.

High-Risk Premium: Token investments are inherently high-risk but offer the potential for substantial rewards, with returns potentially reaching 20x, 50x, or even 100x. This high-reward opportunity is a compelling draw despite the risks.

Lock-Up Periods and Fund Life

A typical lock-up period of 2+1 years is strategically aligned with crypto market cycles, aiming to maximize returns and provide liquidity to investors by the end of 2025 or early 2026.

Token vs. Equity Investments

Liquidity and Flexibility: Tokens generally offer greater liquidity and flexibility than equity. This allows investors to more readily cut losses if a token underperforms, a significant advantage over the longer and more complex exit processes associated with equity.

Compliance and Market Dynamics: The evolving regulatory landscape, such as the imminent Mika regulations in Europe, is anticipated to mitigate compliance risks for token investments.

Investment Criteria and Timing

Vesting Schedules: Careful attention to vesting schedules is crucial to ensure that token releases are well-aligned with the fund’s operational timeline and liquidity requirements.

Deployment Plan: The fund plans to deploy capital strategically by the end of this year and into the first half of the next year, aiming for alignment with market cycles for optimal returns.

Demand and Supply Dynamics

Vertical and Protocol-Level Demand: The success of a token heavily depends on the sector it operates within and the demand at the protocol level. Sectors like DeFi or intersections with AI are particularly promising.

Tokenomics: Effective tokenomics are essential for sustainable demand and performance. They must ensure value accrual, control inflation, and prevent large, premature releases.

Market Strategies and Innovations

Go-to-Market Strategies: It is crucial for projects to have robust strategies for token listings on major exchanges to ensure liquidity and market visibility.

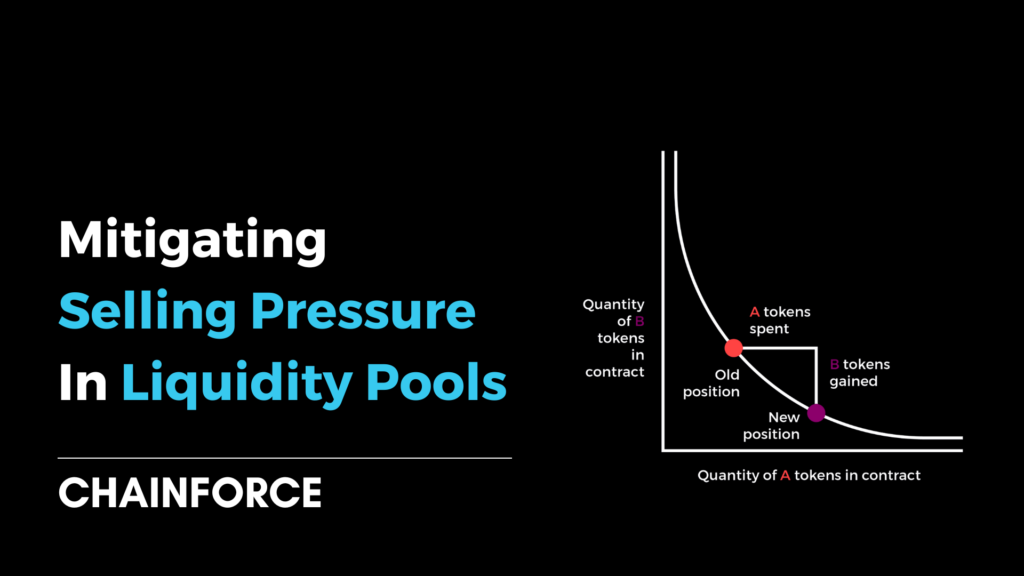

Liquidity Pools and Auctions: Innovative approaches such as liquidity bootstrap pools (LBPs) and decentralized exchange listings can significantly impact long-term performance.

Risk Management and Exit Strategies for Investor Tokenomics

Exit Strategies: Effective risk management requires having liquidity on major exchanges to facilitate smooth exits. This enables funds to manage and reallocate resources efficiently, safeguarding investments against market volatility.

Challenges Faced by Crypto VCs

Regulatory Pressures

Crypto venture capitalists face significant challenges due to the evolving regulatory landscape. The lack of clear regulations and the potential for sudden legal changes create a volatile environment for investment. Regulatory bodies like the SEC have increased scrutiny on crypto firms, accusing some of securities violations, which adds to the uncertainty. This regulatory ambiguity discourages potential investors, affecting the flow of capital into the crypto sector.

Market Uncertainty

The crypto market’s inherent volatility presents another substantial challenge. The dramatic fluctuations in crypto valuations affect investor confidence and funding availability. High-profile failures such as the collapse of FTX and the downfall of major crypto-friendly banks have exacerbated this issue, leading to a cautious approach from investors. The overall decrease in market activity and funding in 2023 highlights the impact of such uncertainties.

Security and Risk Management

Security risks are a major concern for crypto VCs. The sector is prone to significant cybersecurity threats, including hacking and phishing attacks, which can lead to substantial financial losses. Additionally, the collapse of key industry players and ongoing fraud cases have heightened the focus on risk management strategies. Effective security measures and risk management protocols are crucial for maintaining investor trust and safeguarding investments against these prevalent threats.

Notable Success Stories in Crypto VC (Investor Tokenomics)

Major Successful Projects

- Coinbase: Launched in 2012, Coinbase became the largest and most trusted cryptocurrency exchange in the US, achieving a public valuation over $100 billion in April 2021.

- Binance: Established in 2017, Binance quickly rose to become the world’s leading cryptocurrency exchange by trading volume, offering a wide array of services.

- Chainlink: Known as the leading decentralized oracle network, Chainlink connects smart contracts with real-world data, significantly enhancing the functionality of blockchain applications.

- Uniswap: This decentralized exchange on Ethereum revolutionized token trading by enabling swaps without intermediaries, becoming the most popular DEX for ERC-20 tokens.

- Aave: Aave stands out as a leading decentralized lending platform on Ethereum, allowing users to lend and borrow crypto with variable or stable rates.

- Axie Infinity: A pioneer in the play-to-earn gaming model, Axie Infinity attracted millions of players worldwide, creating a new paradigm in the gaming industry.

Learn more: SMARTCON 2023 – CHAINLINK: THE PLATFORM FOR BUILDING THE VERIFIABLE WEB BY SERGEY NAZAROV

Lessons Learned from Success Stories

The success of these projects underscores several key lessons:

- Identifying Market Needs: Successful startups like Coinbase and Binance addressed specific gaps in the crypto market, providing secure trading platforms as the industry grew.

- Innovative Solutions: Chainlink and Uniswap introduced novel solutions that enhanced blockchain functionality and user experience, proving the importance of innovation.

- Community Engagement: Platforms like Axie Infinity demonstrated the power of community-driven growth, leveraging user engagement to propel their platforms.

- Adaptability: All these successful entities adapted quickly to market changes and user demands, which was crucial in their rapid growth and sustainability.

- Strategic Partnerships: Building strategic partnerships was pivotal for many of these projects, helping them to scale effectively and enhance their market presence.

Conclusion about Investor Tokenomics

Through the exploration of crypto venture capital’s evolution, strategies, challenges, and success stories, it’s evident that the landscape of cryptocurrency investment is both complex and dynamic. This article has provided a comprehensive understanding of how investor tokenomics play a pivotal role in navigating the volatile market, highlighting the importance of strategic diversification, adaptability, and innovative investment approaches. The lessons gleaned from the crypto market’s evolution and its impacts on venture capital decisions underscore the vital need for investors to stay informed and agile in their strategies.

As the crypto venture capital sector continues to mature, the significance of these insights cannot be overstressed. They serve not only as a guide for current and aspiring crypto VCs but also pave the way for future innovations within the market. Recognizing the opportunities amidst the challenges will be key to unlocking the potential of crypto investments. For those ready to delve deeper or seek personalized guidance in this ever-evolving investment frontier, scheduling a meeting with a seasoned professional can provide tailored insights and strategies for navigating the crypto VC landscape effectively.

If you’re interested in exploring tokenomics solutions tailored to your needs, you can book a meeting with Chainforce’s experts for personalized guidance.