In the dynamic world of digital assets, liquidity pools are essential for market stability. They facilitate seamless transactions. These pools are pivotal in decentralized finance (DeFi), providing needed market depth and fluidity. Participants can trade assets without causing drastic price movements. Their role is vital in mitigating selling pressure when sell orders exceed buy bids. This can lead to sharp declines in asset prices. Recognizing the significance of liquidity pools is crucial for anyone in the digital asset ecosystem. They directly influence market health and the overall success of tokenomics.

This article delves into the mechanics of liquidity pools and highlights their importance in vibrant market environments. It explores factors contributing to selling pressure and strategies to mitigate these pressures through effective liquidity management. The discussion extends to practical insights on implementing these strategies to ensure liquidity pools work efficiently. This article aims to equip readers with knowledge about liquidity pools. This will help in enhancing market stability and fostering a robust economic model in tokenomics.

Understanding Liquidity Pools and Their Importance

What are Liquidity Pools?

Liquidity pools are foundational elements in decentralized finance (DeFi). They facilitate seamless trading by pooling funds in smart contracts. These pools operate on decentralized exchange (DEX) platforms and allow direct peer-to-peer transactions. They do not need traditional financial intermediaries. By staking cryptocurrencies in these pools, liquidity providers earn rewards. These rewards are usually in the form of transaction fees or liquidity provider (LP) tokens. These tokens can be used within the DeFi ecosystem for various functions. They enhance the liquidity provider’s potential for profit.

Why are Liquidity Pools Important in DeFi?

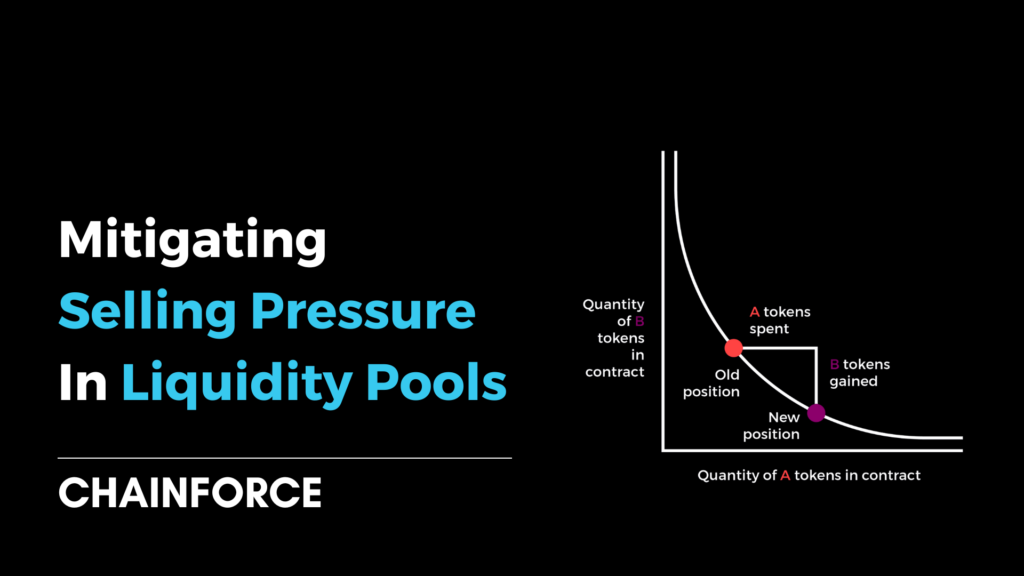

The importance of liquidity pools in DeFi cannot be overstated. They provide the stability and liquidity needed for decentralized exchanges. They use automated market makers (AMMs) to function. AMMs are algorithms that facilitate trading by automatically determining prices. They base these prices on supply and demand. AMMs do not require a traditional order book. This system reduces the spread between buy and sell orders. It minimizes slippage and ensures faster transaction times. Liquidity pools are crucial for enabling features like yield farming. Users stake their cryptocurrencies to earn tokenized rewards. This attracts more participants and capital to the DeFi space.

Types of Liquidity Pools

There are several types of liquidity pools, each designed to meet different needs within the DeFi market. Some pools are tailored for general trading and include a diverse range of crypto assets. They allow users to swap various tokens efficiently. Other pools focus on specific token pairs to cater to niche market demands. They also support new tokens seeking market exposure. Additionally, Some pools offer increased rewards to compensate for higher risks like impermanent loss. This occurs when the value of deposited tokens changes from their initial deposit.

Each type of pool plays a strategic role in the broader DeFi ecosystem, providing essential liquidity and facilitating the rapid growth and adoption of decentralized financial services.

Factors Contributing to Selling Pressure

Market Volatility

Market volatility significantly influences selling pressure in the cryptocurrency market. High volatility often incites a sense of urgency among investors, leading to rapid sell-offs during downturns. This behavior is exacerbated during periods of economic uncertainty or when unexpected events cause sudden market shifts. Historical data, such as that from the St. Louis Fed’s equity volatility tracker, shows that periods of high volatility are frequently associated with economic downturns, further fueling investor anxiety and subsequent selling pressure.

Token Unlock Events

Token unlock events are pivotal moments that can lead to increased selling pressure. These events involve the scheduled release of previously locked tokens into the circulating supply, often resulting from initial coin offerings (ICOs) or other funding rounds. For example, significant token unlocks in cryptocurrencies like Avalanche and Axie Infinity have led to substantial amounts of tokens entering the market, potentially devaluing the existing tokens due to increased supply. Investors and traders must monitor these events closely as they can lead to price volatility and influence market dynamics.

Learn more with Chainforce article : HOW TO NAVIGATE A TOKEN VESTING SCHEDULE FOR OPTIMAL RESULTS

Investor Behavior

Investor behavior also plays a crucial role in contributing to selling pressure. Behavioral finance suggests that investors are not always rational and are often influenced by psychological biases. For instance, the disposition effect may cause investors to sell off assets prematurely in volatile markets to avoid further losses. Additionally, herding behavior can amplify market movements, as investors mimic the actions of the majority without thorough analysis. This can lead to significant selling pressure when the market sentiment is bearish, further driving down prices. Understanding these behavioral patterns is essential for navigating the complexities of the crypto markets and mitigating potential risks associated with selling pressure.

Strategies to Mitigate Selling Pressure via Liquidity Pools

Increasing Liquidity Pool Depth

Liquidity pools enhance market dynamics by allowing assets to be traded with minimal impact on market prices. High liquidity in these pools ensures that large orders can be executed without significant price slippage, thereby stabilizing prices during volatile periods. For instance, in decentralized finance (DeFi), liquidity providers contribute to pools on automated market maker (AMM) platforms, earning fees and rewards, which in turn attracts more capital, increasing the depth of the pool. The increased depth helps absorb large trades without causing major price disruptions. This effectively mitigates selling pressure.

Incorporating Buybacks

Token buybacks are a strategic approach used by Founders and Token Operators. They stabilize token prices and provide liquidity during downturns. By repurchasing tokens, companies can reduce supply, thus supporting the token price during periods of selling pressure. This activity benefits retail investors by reducing transaction and price impact costs. It also enhances overall market stability. Proactive repurchase activities, especially during times of expected higher volatility or policy uncertainty, serve as a crucial buffer against market downturns.

Utilizing Market Makers

Market makers play a pivotal role in maintaining liquidity and ensuring continuous trading activities. They are always ready to buy or sell, which is crucial during periods when immediate market participants are scarce. In both traditional and decentralized markets, market makers help narrow the bid-ask spread, reduce price volatility, and facilitate efficient price discovery. In DeFi, market makers contribute to liquidity pools using AMM protocols, ensuring there is sufficient liquidity to execute trades even in times of market stress. By doing so, they help cushion the market against excessive price movements and provide stability.

By implementing these strategies, liquidity pools can be effectively utilized to mitigate selling pressure, ensuring a more stable and resilient market environment.

Implementing Effective Liquidity Pools

Setting Up a Liquidity Pool

Establishing a liquidity pool involves more than simply selecting token pairs and providing initial liquidity. The foundational decisions made during this phase can significantly impact the pool’s performance and overall market stability. According to Kairon Labs’ blog on token launches, liquidity is vital for ensuring that markets remain active and prices do not fluctuate drastically due to insufficient trading volumes. A robust approach includes careful selection of token pairs, initial liquidity provision, and incentives for liquidity providers.

Choosing the right token pairs is crucial. It’s important to analyze the correlation and volatility of the pairs to minimize impermanent loss—a common risk in liquidity pools where the relative value of assets changes. For example, pairing a stablecoin with a more volatile token can provide a buffer against market swings. Additionally, setting an initial price for the token pair that reflects market expectations and fundamental value is key to avoiding drastic price changes once trading begins.

Another critical factor is the amount of initial liquidity provided. This should be sufficient to handle average trade sizes without significant slippage, which can deter traders from participating. Using insights from simulations and historical data can help determine the optimal level of liquidity required at launch. Furthermore, launching on multiple decentralized exchanges (DEXs) or cross-chain platforms can enhance visibility and reduce concentration risk, as highlighted by Cointelegraph’s exploration of multichain token systems.

To incentivize participation, consider implementing a rewards program for liquidity providers. These incentives, such as LP tokens or additional staking rewards, not only attract initial liquidity but also encourage long-term commitment to the pool. Such strategies can help build a loyal base of liquidity providers, which is essential for maintaining pool stability over time.

Managing Liquidity Pool Dynamics

Once a liquidity pool is operational, ongoing management is required to maintain balance and optimize performance. One of the primary challenges is managing impermanent loss. This can be mitigated through strategies such as pairing less volatile assets or using synthetic assets and derivatives that mirror the price movements of the underlying tokens.

Dynamic fee models are another tool for managing liquidity pool dynamics effectively. Adjusting fees based on market conditions can help compensate liquidity providers during periods of high volatility. For instance, higher fees during market downturns can offset potential losses and encourage providers to keep their funds in the pool.

It’s also important to actively monitor liquidity pool health using data analytics tools. Platforms like Dune Analytics or custom-built dashboards can provide real-time insights into key performance indicators such as liquidity depth, trading volume, and fee earnings. This data can inform decisions on when to adjust fees, rebalance the pool, or introduce new incentives to maintain optimal liquidity levels.

Moreover, integrating smart contract-based automation can streamline pool management. For example, automated rebalancing strategies can ensure that the pool maintains a target ratio of assets, reducing the need for manual intervention and lowering operational risks. This approach, mentioned in the LinkedIn article on reverse liquidity bootstrap pools, helps maintain consistent liquidity even during periods of high market volatility.

Monitoring and Adjusting Strategies

Effective liquidity management requires continuous monitoring and adjustments to adapt to changing market conditions. The ability to validate and optimize strategies using on-chain data is critical. Utilizing multichain analytics can provide a broader view of liquidity across different networks, helping to identify trends and adjust strategies accordingly.

Validation of pool strategies can be achieved through simulations that use historical and real-time on-chain data. These simulations can stress test the liquidity pools under various market scenarios, such as sudden price drops or unexpected surges in trading volume. This proactive approach, recommended by the Medium article on managing price stability, allows liquidity managers to preemptively adjust parameters like fees or liquidity levels to cushion against potential market disruptions.

Optimization tools like Token Terminal provide advanced analytics and simulations to fine-tune liquidity pool settings. These tools can help identify the most efficient fee structures, rebalance intervals, and reward schedules to maximize pool performance and provider satisfaction.

Risk management should also be a key focus, with regular audits of smart contracts governing the liquidity pools. This ensures that the pools are not only secure but also economically robust. Engaging third-party firms for comprehensive audits and leveraging decentralized insurance solutions like Nexus Mutual can further safeguard against liquidity risks.

Finally, having an exit strategy is essential for liquidity providers. Understanding potential impermanent loss, transaction fees, and any exit penalties is crucial before withdrawing from a pool. Regularly reviewing pool performance and market conditions can help providers make informed decisions about when to exit or adjust their participation levels.

By integrating these strategies, liquidity pools can be effectively managed to maintain market stability, reduce selling pressure, and foster a resilient trading environment. The dynamic nature of tokenized markets requires a proactive approach to liquidity management, using both data-driven insights and strategic interventions to ensure the long-term success of digital asset ecosystems.

Conclusion

Liquidity pools are crucial to maintaining market stability in the DeFi space, allowing assets to be traded smoothly while mitigating selling pressure that can destabilize prices. By carefully setting up liquidity pools with the right token pairs, sufficient initial liquidity, and effective incentives for participation, these pools can provide the depth needed to absorb large trades without significant price impact.

Managing liquidity pools involves ongoing adjustments to minimize risks like impermanent loss and to adapt to market conditions. Using dynamic fee models, integrating synthetic assets, and employing smart contract automation can enhance pool resilience. Continuous monitoring with on-chain data and simulations ensures that liquidity strategies remain effective and responsive to market shifts.

Effective liquidity management is essential for the success of tokenized ecosystems, requiring a proactive approach that combines strategic setup, active management, and rigorous monitoring. By implementing these best practices, liquidity pools can serve as powerful tools to stabilize markets, reduce selling pressure, and foster a robust and sustainable digital asset environment.

To explore tailored strategies that cater to your specific needs in tokenomics, consider booking a call with Vincent, our founder, to talk about your tokenomics. This engagement could prove pivotal in leveraging liquidity pools for not only mitigating selling pressure but also in ensuring the long-term success and stability of digital asset markets.