Tokenomics integrates tokens with economics. This field governs the fundamental mechanics of cryptocurrencies and their ecosystems. A pivotal aspect of tokenomics is liquidity. It plays a crucial role in determining a token’s price movement and overall market dynamics. Liquidity refers to the ease with which tokens can be converted into other digital assets or cash without significantly impacting their price.

In the realm of tokenomics, there are two primary approaches to liquidity creation. These are decentralized exchanges (DEXs) and centralized exchanges (CEXs). This article explores the intricacies of these two models. It examines their merits and drawbacks in fostering liquidity within token markets. We will examine the comparative analysis of DEX and CEX liquidity, providing valuable insights for investors, traders, and project developers alike.

Understanding Liquidity in Token Markets

Token liquidity is an essential aspect of any blockchain-based ecosystem. It refers to the ease with which a particular token can be bought or sold on an exchange without affecting its market price significantly. In other words, liquidity refers to the ability to convert a token into cash or another cryptocurrency quickly and easily.

A liquid market is considered more steady and less volatile. It harmonizes buy and sell market forces through active trading. Moreover, liquidity in cryptocurrency makes it less susceptible to manipulations of the market by dishonest actors or groups of actors.

Decentralized Liquidity (DEX)

Decentralized exchanges (DEXs) rely on liquidity pools. These pools are smart contracts that hold reserves of various cryptocurrencies. These pools enable trustless and automated trading without intermediaries.

Overview of DEX

DEXs are peer-to-peer marketplaces built on blockchain networks. They allow traders to exchange cryptocurrencies via smart contracts. They offer a decentralized alternative to traditional centralized exchanges. Indeed, they provide users with greater control and autonomy over their assets. The most well-known DEXs are Uniswap, SushiSwap, and PancakeSwap.

Mechanisms of Creating Liquidity in DEX

- Liquidity Pool Creation: To establish a liquidity pool, users deposit equal values of two tokens, forming a trading pair (e.g., BTC and ETH). The pool’s liquidity is determined by the total value of assets locked within.

- Automated Market Making: DEX protocols employ algorithms and smart contracts to determine token prices based on the ratio of assets in the pool. This enables direct token swapping without order books.

- Liquidity Provider Incentives: Liquidity providers earn a share of trading fees as rewards for contributing their assets to the pools, incentivizing them to maintain liquidity.

Advantages of DEX for Liquidity

- Decentralization: DEXs operate without central authorities, promoting transparency and reducing counterparty risk.

- Permissionless Access: Users can participate in liquidity provision and trading without restrictive requirements.

- Composability: DEXs integrate seamlessly with other DeFi protocols, enabling complex financial applications.

- Censorship Resistance: Transactions cannot be censored or blocked by intermediaries, ensuring free and open markets.

Learn more with Chainforce article : INITIAL DEX OFFERING: KEY STEPS TO LAUNCHING A DIGITAL CURRENCY

Centralized Liquidity (CEX)

Centralized exchanges (CEXs) act as intermediaries between buyers and sellers. They facilitate cryptocurrency trading through a centralized platform. These exchanges offer high liquidity, a wide range of trading pairs, and advanced trading features, catering to both novice and experienced traders.

Overview of CEX

CEXs function as centralized marketplaces. All transactions and order matching take place on the exchange’s servers. Users must deposit their funds into wallets controlled by the exchange to access the platform’s trading services. Popular CEXs include Coinbase, Binance, Kraken, and others.

Mechanisms of Creating Liquidity in CEX

- Order Books: CEXs maintain order books that aggregate buy and sell orders. The depth and volume of these orders enhance the exchange’s overall liquidity.

- Market Makers: CEXs often collaborate with market makers. These partners help provide liquidity by continuously placing buy and sell orders, ensuring steady trading activity.

- Trading Pairs: CEXs offer a wide range of trading pairs, allowing users to trade various cryptocurrencies against each other or against fiat currencies, increasing liquidity across multiple markets.

Advantages of CEX for Liquidity

- High Trading Volumes: CEXs typically have higher trading volumes compared to decentralized exchanges, enabling users to execute trades quickly at desired prices.

- Advanced Trading Features: CEXs offer advanced trading features like margin trading, futures contracts, and options trading, attracting more traders and increasing liquidity.

- User-Friendly Interfaces: CEXs often provide intuitive user interfaces and tools, making it easier for users to participate in the market, contributing to increased liquidity.

- Regulatory Compliance: Many CEXs operate under regulatory guidelines, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, providing a level of legitimacy that may appeal to certain users and contribute to liquidity.

Comparative Analysis of DEX and CEX Liquidity

Liquidity Pools in DEX vs Order Books in CEX

Liquidity is a crucial factor in determining the efficiency and ease of trading. Centralized exchanges (CEXs) typically offer higher liquidity due to their established market presence and larger user bases. This situation improves price discovery. It also facilitates the buying and selling of cryptocurrencies at desired prices. On the other hand, decentralized exchanges (DEXs) rely on user-provided liquidity pools. This is especially true for those utilizing automated market maker (AMM) protocols. DEX liquidity has been growing steadily. However, it remains generally lower than that of CEXs. Consequently, larger orders on DEXs may experience slippage and impact the execution price.

Security Considerations

Security is crucial when choosing an exchange. CEXs, due to their centralized nature, are more susceptible to hacking attempts. If a CEX’s security measures are compromised, users’ funds could be at risk. However, reputable CEXs invest heavily in security. This mitigates these risks. In contrast, DEXs provide higher security. Their decentralized storage of funds makes it harder for hackers to compromise user assets. However, choosing DEXs with robust smart contract security is essential. This ensures the safety of funds.

User Experience and Accessibility

The user experience (UX) of an exchange influences the trading journey. This is particularly true for beginners. CEXs often prioritize user-friendly interfaces and provide intuitive features, making them more accessible for users with limited trading experience. Additionally, CEXs offer customer support services to assist users with their trading needs. DEXs, particularly those utilizing AMM protocols, can have a steeper learning curve as they require interacting with smart contracts and managing non-custodial wallets, which may require some technical understanding. However, DEXs continuously improve their UX to enhance accessibility for users of all experience levels.

Learn more about Chainforce methodology : Tokenomics Methodology

Challenges and Opportunities of Liquidity in Token Markets

Challenges

Maintaining Liquidity

Maintaining adequate liquidity is a constant challenge in the cryptocurrency markets. For newer or less popular tokens, this can be particularly daunting as they may not attract enough trading volume, leading to wider spreads between buy and sell prices and potentially deterring further participation from traders. For projects, the challenge lies in continuously attracting and retaining both traders and liquidity providers to ensure that their tokens remain liquid under various market conditions.

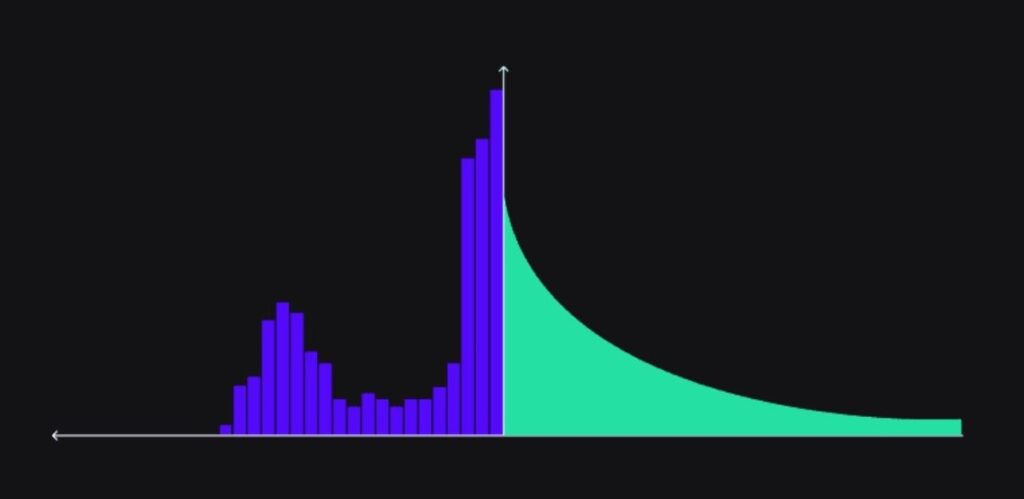

Handling Sell Pressure

Sell pressure occurs when a large volume of tokens is sold off quickly, usually in response to adverse market conditions or news, leading to a sharp drop in token prices. Managing sell pressure is crucial because failure to do so can lead to panic selling, further driving the price down. This scenario is particularly challenging during market downturns or when large investors, or ‘whales,’ decide to offload significant amounts of tokens.

Price Stability

Price stability is essential for the long-term viability of any token. High volatility can deter investment, especially from institutional or risk-averse investors. Maintaining price stability involves managing the token’s supply and demand dynamics effectively. This can be challenging due to external market factors, speculative trading, and the inherent volatility of the crypto markets.

Opportunities

Liquidity Mining

Liquidity mining is a process where blockchain projects incentivize users to supply liquidity to their pools through rewards, typically distributed in the form of additional tokens. This mechanism not only boosts liquidity but also helps in distributing the token to a broader user base, potentially increasing adoption and participation in the ecosystem. Liquidity mining can be a win-win for both the project and the liquidity providers, as it rewards providers for contributing to the token’s market stability and depth.

Liquidity Bootstrapping

Liquidity bootstrapping pools (LBPs) are designed to help projects create a fair and capital-efficient market for their new tokens. By using a smart contract that automatically adjusts the token’s price and supply, LBPs can protect against market manipulation and provide a more controlled environment for token distribution. This approach allows projects to increase their liquidity gradually while minimizing front-running and other exploitative trading practices that can occur during token launches.

Weighted Liquidity Pools like Balancer

Balancer pools are an innovative solution to liquidity that allow for the creation of self-balancing weighted portfolios. Unlike traditional liquidity pools that require a 50/50 split of assets, Balancer enables custom ratios, thereby offering more flexibility in managing liquidity. This can be particularly useful for projects that need to manage large reserves of their own tokens while still providing liquidity to the market.

Multi-chain Tokens

As blockchain technology evolves, there is a growing opportunity to enhance liquidity through multi-chain tokens. These tokens can exist across multiple blockchain platforms, increasing their accessibility and usability. By leveraging the unique features of different blockchains, projects can maximize their exposure and utility across diverse ecosystems, thus broadening their appeal and boosting liquidity.

Cross-chain Liquidity Incentivization

As the DeFi ecosystem expands, the integration of cross-chain liquidity incentivization layers becomes crucial for enhancing market efficiency and accessibility. An excellent example of this is Kaskade’s approach to liquidity management across multiple blockchains. Kaskade has been at the forefront with its volume bootstrapping methods, which strategically control and direct liquidity incentives not only across different decentralized exchanges but also across various decentralized applications (dApps) on multiple networks. This technique helps to ensure that liquidity is not only available but also optimally distributed, promoting deeper market penetration and reducing the risk of liquidity silos that can hinder the usability and adoption of blockchain technology.

Conclusion

As the dynamics of tokenomics continue to evolve, managing liquidity effectively remains a cornerstone in determining the success of any token ecosystem. The interplay between decentralized (DEXs) and centralized exchanges (CEXs) offers a spectrum of strategies for liquidity management, each with its unique advantages and complexities.

Navigating these complexities involves a strategic approach that includes understanding the selling pressures that may affect token stability. A thorough market analysis is essential to anticipate potential sell-off triggers and understand their likely impact on the token’s price. This includes monitoring the activities of large token holders and assessing overall market sentiment. Implementing vesting schedules and lock-up periods for early investors and team members can also mitigate the risk of sudden large sell-offs that could destabilize the token price.

In planning for a Token Generation Event (TGE), it is critical to balance the initial supply to meet but not overwhelm market demand. A structured, phased release of tokens can help manage supply effectively, aligning it with incremental increases in market demand and trading activity. This approach not only prevents excessive initial supply leading to price drops but also promotes price stability as the project matures.

If you’re interested in exploring tokenomics solutions tailored to your needs, you can book a meeting with Chainforce’s experts for personalized guidance.