In 2024, the world of blockchain-based fundraising is undergoing a significant transformation. Token launches, a pivotal component of blockchain projects, continue to be a popular method for raising capital and engaging with communities. Tokens serve as a versatile fundraising tool, allowing projects to quickly access liquidity. They also help incentivize early supporters and provide governance mechanisms. However, the dynamics surrounding token launches have evolved, influenced by changing market conditions and innovative fundraising models.

One of the key factors that define the success of a token launch is liquidity. It refers to the ease with which a token can be bought or sold without causing significant price fluctuations. High liquidity ensures price stability and attracts more investors, whereas low liquidity can lead to high volatility and discourage participation.

This article delves into the current trends in token launches and sales in 2024. It focuses on the ongoing debate between two predominant models: Low Fully Diluted Valuation (FDV) with fair token distribution versus Low Float/High FDV setups. While Low FDV strategies promote equitable access and sustainable growth, High FDV models with limited circulating supply aim to create scarcity and drive initial hype. Both approaches have their pros and cons. Understanding these nuances is vital for project founders looking to navigate the complex landscape of token fundraising.

Opportunity of Tokens for Fundraising and the Importance of Liquidity

Tokens have emerged as a powerful and versatile tool for fundraising in the blockchain ecosystem. They enable projects to raise capital, incentivize community participation, and bootstrap their ecosystems. Unlike traditional fundraising methods, token sales provide blockchain projects with a unique mechanism. They attract both retail and institutional investors globally. Through Initial Coin Offerings (ICOs), Security Token Offerings (STOs), Initial DEX Offerings (IDOs), and other innovative models, projects can raise funds directly from a decentralized pool of investors. These models offer digital assets that have potential value, governance rights, or utility within a network.

However, the effectiveness of a token as a fundraising tool is heavily dependent on its liquidity in the market. Liquidity is the ability to quickly and efficiently buy or sell a token without causing significant changes in its price. It plays a crucial role in determining a token’s stability and attractiveness to investors. High liquidity leads to price stability and reduces volatility. It makes the token more appealing to both short-term traders and long-term investors. Furthermore, high liquidity ensures a more efficient market where orders can be filled promptly. This enables seamless trading experiences and fosters a positive perception among investors.

To maintain such liquidity in token markets, many projects engage Market Makers. These are entities that provide liquidity by constantly buying and selling tokens. Market Makers ensure that there are always buyers and sellers available at any given time. This reduces price slippage and volatility. This creates a more stable and predictable trading environment, which in turn encourages greater participation from investors and traders. Maintaining adequate liquidity is not just about enabling smooth transactions. It is also about sustaining market confidence, ensuring fair price discovery, and attracting long-term capital to the ecosystem.

Current State of Token Launches and Market Dynamics in 2024

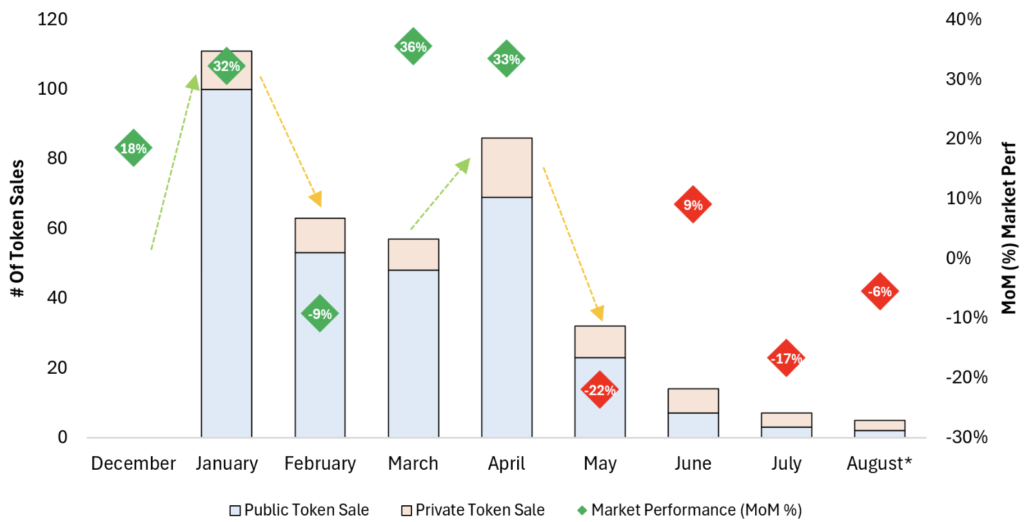

The token launch landscape in 2024 reflects a dynamic and evolving market. It is shaped by a mix of innovative fundraising strategies, shifting investor preferences, and broader market trends. According to data from Outlier Ventures and other sources, the trends in token launches reveal a strong inclination toward public sales. There is also a shift in capital deployment across different fundraising stages, and varying behaviors between traditional venture funding and token-based fundraising.

Public vs. Private Token Sales Trends

As of 2024, public token sales have dominated the fundraising scene, accounting for approximately 81% of all token launches year-to-date (YTD). This trend indicates a strong preference for public listings over private sales. It is driven by several factors, including market transparency, the ability to engage a broader investor base, and the regulatory clarity that public sales can provide. Unlike private token sales, which often involve larger allocations to institutional investors or venture capitalists, public sales tend to democratize access to tokens. This allows retail investors to participate more readily. This has fostered a more inclusive ecosystem where diverse groups of investors can engage with new projects from the ground up.

# of public and private token launches vs % MoM of the Altcoin Marketcap

Fundraising Trends Across Different Stages

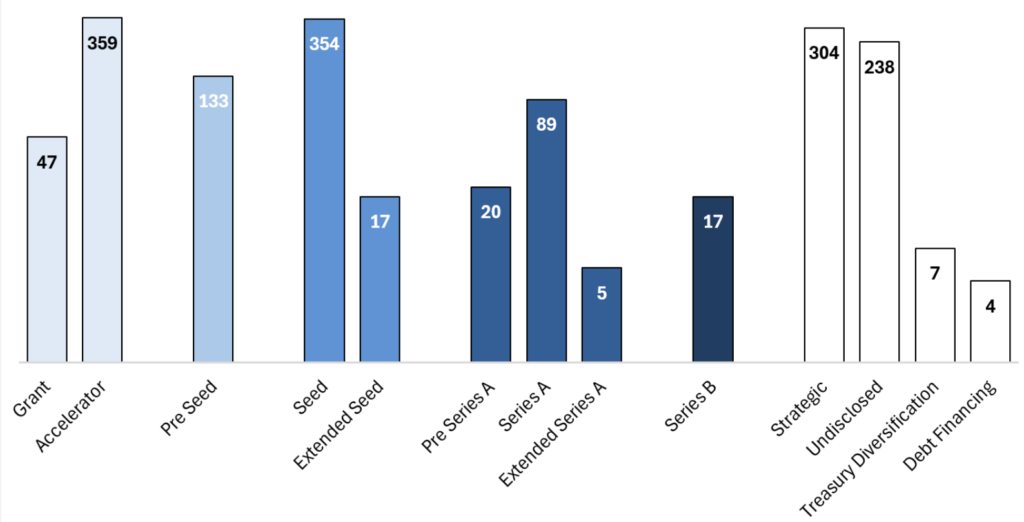

Fundraising trends across different stages—such as Pre-Seed, Seed, Series A, and beyond—exhibit notable differences. These differences are between traditional venture capital and token-based sales. For instance, the most active stage for traditional deals remains the Seed stage, followed closely by Accelerator and Pre-Seed stages. The difference between Pre-Seed and Seed is becoming less distinct. Token sales are increasingly entering the mix, often substituting for early-stage funding. The data shows that the number of accelerator deals YTD is notably high. This reflects a growing interest in early-stage projects as the market cycles heat up and more ecosystem-specific accelerators emerge.

Number of deals YTD across different stages (excl. Token Sales)

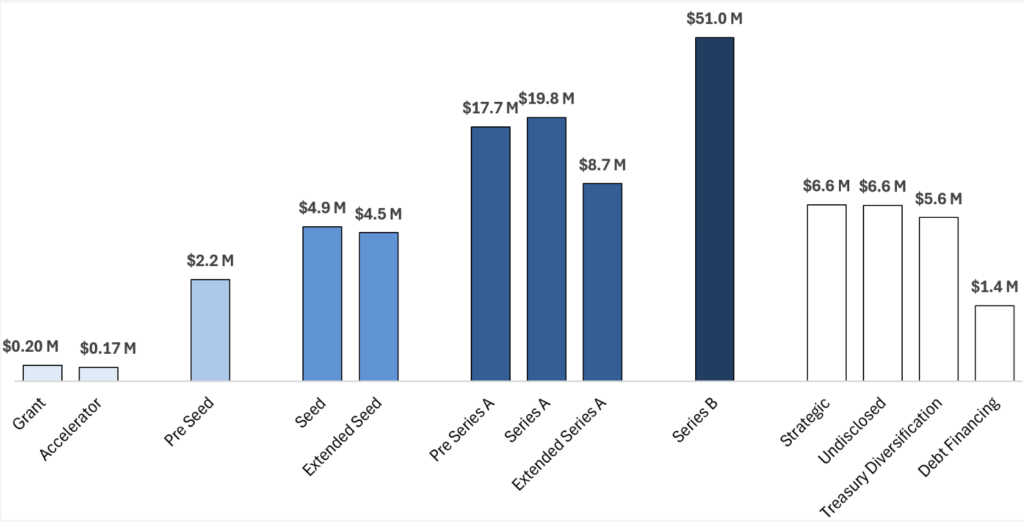

When examining capital deployment, the average ticket sizes also vary across different fundraising stages. In 2024, traditional venture deals show average ticket sizes of $2.2 million for Pre-Seed, $4.9 million for Seed, $19.8 million for Series A, and $51 million for Series B.

Average Ticket Size ($M) Per Deal Stage

However, token sales tend to react more to market movements and conditions, with significant activity observed following positive market shifts. This responsiveness highlights the speculative nature of token-based fundraising compared to the more predictable patterns seen in traditional venture funding.

Low FDV / Fair Token Launches vs. Low Float / High FDV Models

As the token market matures, two distinct models for launching and pricing tokens have emerged: Low Fully Diluted Valuation (FDV) with fair token launches and Low Float/High FDV models. Each approach has its own set of advantages and drawbacks, making the choice between them a critical decision for project founders.

Low FDV / Fair Token Launches

The Low FDV / Fair Token Launch model emphasizes transparency, equitable access, and sustainable growth. In this model, tokens are launched at a lower FDV, meaning the total potential market cap of all tokens, including those yet to be issued, is kept relatively modest.

Pros

- Transparent Pricing: By setting a lower FDV, projects provide more realistic and transparent pricing that reflects the early-stage nature of the project. This fosters trust among investors who feel they are buying in at a fair valuation.

- More Equitable Distribution: While a low FDV alone does not necessarily ensure a more equitable distribution, when combined with a larger circulating supply at launch, it can promote broader access for retail investors and help avoid concentrated ownership among a few large players.

- Higher Initial Liquidity: With more tokens available in circulation from the outset, liquidity tends to be higher, leading to better price stability and reducing the risk of extreme price swings.

- Better Price Discovery: A fair token launch allows the market to determine the price more organically based on supply and demand dynamics, ensuring a healthier price discovery process.

Cons

- Potential Undervaluation: A low FDV might undervalue the project’s potential, especially if the market does not recognize its future growth prospects. This could lead to the token being perceived as less valuable.

- Risk of Rapid Sell-Offs: If the community loses confidence or if initial investors are short-term speculators, there is a risk of rapid sell-offs that could significantly affect the token price. Without robust long-term holders, the token could struggle to maintain its value.

Low Float / High FDV Models

The Low Float / High FDV model is often favored by projects aiming to create initial scarcity and hype. In this model, only a small portion of the total token supply is made available at launch (low float), while the FDV is set high, suggesting a potentially massive market cap. This model has different implications:

Pros

- Creates Initial Scarcity: By limiting the number of tokens available at launch, the model creates artificial scarcity, which can drive up demand and price in the short term.

- Drives Hype: The combination of a high FDV and low float can generate significant market hype, attracting speculative traders looking for quick gains.

- Potentially Higher Initial Market Cap: The perceived value created by high FDV can result in a higher initial market cap, which can be advantageous for marketing and visibility.

Cons

- High Volatility: The scarcity of tokens combined with speculative trading can lead to extreme volatility. This environment can be risky for retail investors and can quickly erode confidence if the price fluctuates wildly.

- Market Manipulation Risk: With a limited number of tokens available, prices are more susceptible to manipulation by large holders or coordinated groups, potentially leading to unfair market practices.

- Unsustainable Prices: High initial prices driven by scarcity and hype are often not sustainable. As more tokens are released into circulation over time, prices may drop sharply, causing losses for those who bought in at peak prices.

- Discourages Long-Term Holders: The volatility and speculative nature of this model can deter long-term holders who prefer stable, predictable growth over short-term gains.

Lessons and Considerations for Founders Planning Token Launches

Key Lessons

- Understanding Market Conditions and Timing the Launch: Successful token launches are often timed to align with favorable market conditions. Founders should monitor broader market trends and sentiment to choose an optimal launch window that maximizes visibility and investor interest.

- Aligning Tokenomics with Project Goals and Community Interests: Tokenomics should be designed to foster long-term community engagement and trust. Fair pricing, clear distribution mechanisms, and incentives that align with the project’s vision can help attract a committed community of supporters.

- Transparency in Pricing and Unlock Schedules: Transparent communication regarding pricing models, token supply, and unlock schedules is essential for maintaining investor confidence. Hidden or misleading information can lead to distrust, damaging the project’s reputation and long-term prospects.

Considerations for Founders

- Balancing Between Initial Token Supply and Long-Term Sustainability: Founders must carefully balance the initial token supply to avoid excessive scarcity or overvaluation. A well-calibrated initial supply can prevent extreme volatility and encourage more stable growth over time.

- Designing Effective Vesting Schedules and Reward Mechanisms: Implementing vesting schedules that gradually release tokens and incorporating reward mechanisms such as staking or airdrops can help reduce selling pressure and build a loyal community. These tools can incentivize long-term holding and participation, enhancing the token’s value stability.

- Adopting a Balanced Approach Between Equity and Token Sales: Founders should consider a hybrid approach that combines equity and token sales, ensuring fair access for both private and public investors. This approach can help diversify the investor base, stabilize the market, and align the interests of all stakeholders.

If you’re looking to craft a successful token launch strategy and need tailored tokenomics solutions, book a meeting with Chainforce’s experts for personalized guidance to elevate your project to the next level!