Build, Launch & Operate Your Token – Event by Chainforce

Together with our partners, we’re hosting a 2-hour deep dive into the essential steps that founders must take during tokenization.

Together with our partners, we’re hosting a 2-hour deep dive into the essential steps that founders must take during tokenization.

Understanding the definition and basics of tokenomics is essential for anyone involved in the crypto space or managing a Web3 project.

We are excited to announce our partnership with TokenOps to offer unparalleled end-to-end token and treasury management solutions.

In 2024, token launches continue to be a popular method for raising capital and engaging with communities.

We are excited to announce a partnership between Chainforce and LegalNodes, aimed at providing robust legal solutions.

Cross and multi-chain liquidity significantly bolster user participation in the decentralized finance (DeFi) sector.

Crypto VCs often focus on early-stage investments driven by the potential for high growth in emerging crypto markets.

There are two primary approaches to liquidity creation. These are decentralized exchanges (DEXs) and centralized exchanges (CEXs).

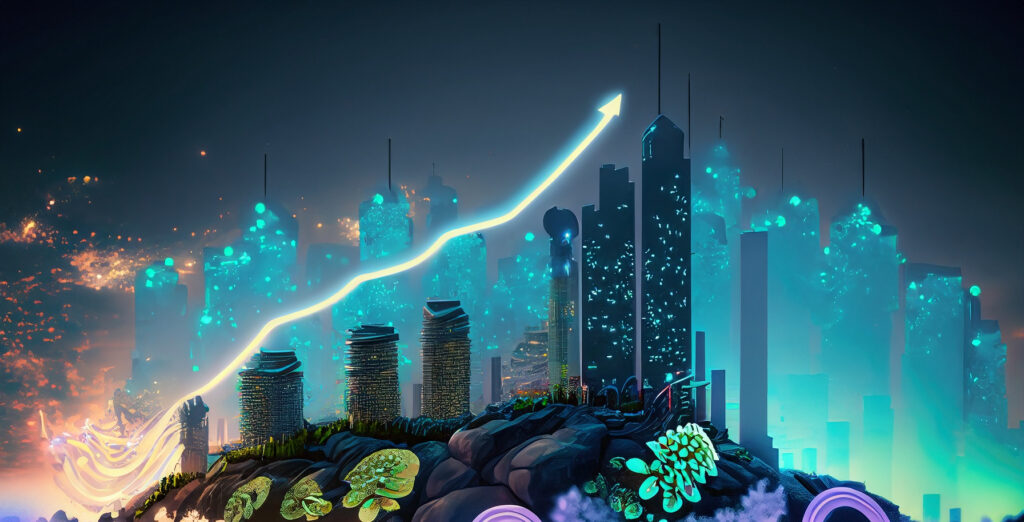

The article explores token vesting schedules and their significance in tokenomics, detailing various types and providing guidance for designing tokenomics tailored to specific project needs. It addresses common challenges and aims to equip stakeholders with the knowledge and tools for strategic alignment with project objectives and timelines.