Arbitrum is a cutting-edge Layer 2 scaling solution designed to enhance Ethereum’s capabilities by improving its scalability and reducing transaction costs. Built on the foundation of optimistic rollup technology, Arbitrum enables faster and more cost-efficient transactions without compromising on security. This innovative platform facilitates a seamless execution of smart contracts and decentralized applications (DApps) at a fraction of the time and cost associated with the Ethereum mainnet.

In March 2023, the Arbitrum ecosystem took a significant leap forward with the introduction of its token, ARB. The launch of the ARB token is a milestone in Arbitrum’s journey, symbolizing a shift towards a more decentralized governance model. Holders of the ARB token have the power to participate in the decision-making processes that shape the future of the Arbitrum network, from protocol upgrades to community initiatives. The introduction of ARB not only empowers its community but also reinforces Arbitrum’s commitment to fostering an inclusive and democratized blockchain ecosystem.

Arbitrum – Token Utility

The utility of the ARB token is primarily focused on governance within the Arbitrum ecosystem. With the announcement of the ARB token launch, the Arbitrum Foundation introduced a pioneering self-executing DAO (Decentralized Autonomous Organization) governance model for the Arbitrum One and Arbitrum Nova networks. This groundbreaking approach to Layer 2 solution governance positions Arbitrum as a leader in the space, emphasizing its commitment to decentralized and efficient decision-making processes. Unlike ETH, which is utilized for paying transaction fees on both Ethereum and Arbitrum, the ARB token’s sole function is for protocol governance.

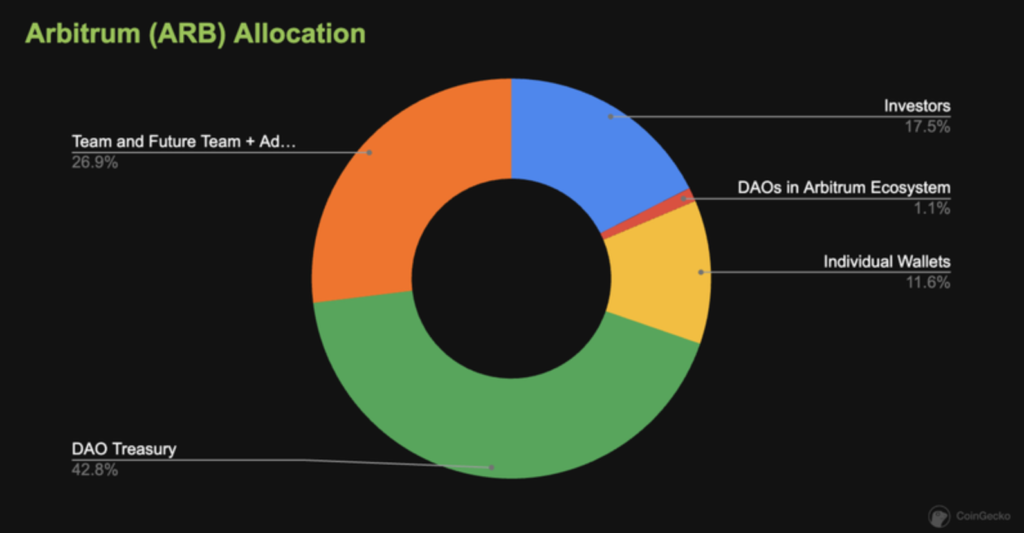

Arbitrum – Token Allocation

The token allocation for Arbitrum ($ARB) is as follows:

- Offchain Labs Investors: 17.53% of the supply, equating to 1.753 billion tokens.

- DAOs within the Arbitrum Ecosystem: 1.13%, or 113 million tokens.

- Arbitrum Platform Users: 11.62%, amounting to 1.162 billion tokens.

- Arbitrum DAO Treasury: Receives the largest share with 42.78% or 4.278 billion tokens.

- Offchain Labs Team, Future Team, and Advisors: 26.94%, totaling 2.694 billion tokens.

A significant 12.75% of the total $ARB token supply was airdropped on March 23, 2023, highlighting the project’s commitment to rewarding its community and fostering a decentralized governance structure. With an initial total supply of 10 billion tokens and an inflation rate capped at a maximum of 2% per year, Arbitrum aims to maintain a balanced ecosystem.

This allocation strategy ensures that 55.53% of the tokens are under the community’s control, with a significant portion reserved for the Arbitrum DAO Treasury. This democratic approach empowers $ARB holders to influence the project’s direction through voting, emphasizing Arbitrum’s dedication to a community-led future.

Arbitrum – Token Distributions based on Cliffs and Vesting

For both the Team and Advisors, and the Investors, there’s a four-year vesting schedule with monthly unlocks running from March 23, 2023, to March 23, 2027. This schedule includes a one-year cliff period from March 23, 2023, to March 23, 2024.

The Arbitrum DAO Treasury will be fully unlocked on March 23, 2023, with its distribution schedule to be determined by governance decisions.

Both user and DAO airdrops are set to be fully unlocked on March 23, 2023.

As the cliff period for both the Team and Advisors, as well as the Investors, concludes, the initial token release is imminent. This leads to a pivotal question: Will the upcoming token release exert sell-side pressure and potentially drive down the price of ARB?

Learn more: How to choose the optimal token vesting schedule for your venture?

Arbitrum’s Tokenomics – $2.3 billion token release on March 16, 2024 – Will the market pump or dump?

Tokenomics data reveals that Arbitrum is set to release 1.1 billion ARB tokens, amounting to over 76% of its current total circulation, on the upcoming 16th of March 2024. This significant influx of tokens presents a notable potential to influence the token’s market price.

As of this writing, the impending release of 1.1 billion tokens is estimated to be worth around $2.3 billion, with each ARB token currently valued at $2.03.

Vesting periods, a common practice in the cryptocurrency sector, facilitate a controlled and phased token release. This strategy helps prevent market shock and speculative volatility at the time of launch. However, the release of such a substantial proportion of the supply—76%—could markedly affect the token’s price dynamics.

The market’s response to this release could follow several paths:

- In the event that the individuals who receive the tokens make a collective decision to sell them all, the market could experience a considerable amount of selling pressure. As a result, this could cause a significant drop in the value of the ARB token, leading to potential financial losses for those who hold it. It is important to consider this possibility and make informed decisions when it comes to buying and selling ARB tokens.

- On the other hand, many of the recipients are within the development teams. A considerable portion of the tokens might be sold to secure liquidity for future developments of the ecosystem, creating selling pressure. However, a significant portion may also be retained by these same teams, especially those with a long-term interest in the project, which could lessen the impact of a massive sell-off.

- Market anticipation and strategic positioning are also crucial factors. The release might not negatively impact the ARB price if investors have already accounted for it by adjusting their holdings accordingly. For example, Spot on Chain reports indicate that whales have moved over $5 million worth of ARB tokens to Binance, possibly in preparation to leverage the forthcoming release on March 16th.

The market’s reaction will become clearer in the days following the release, offering a better gauge of ARB’s price trajectory

Sources